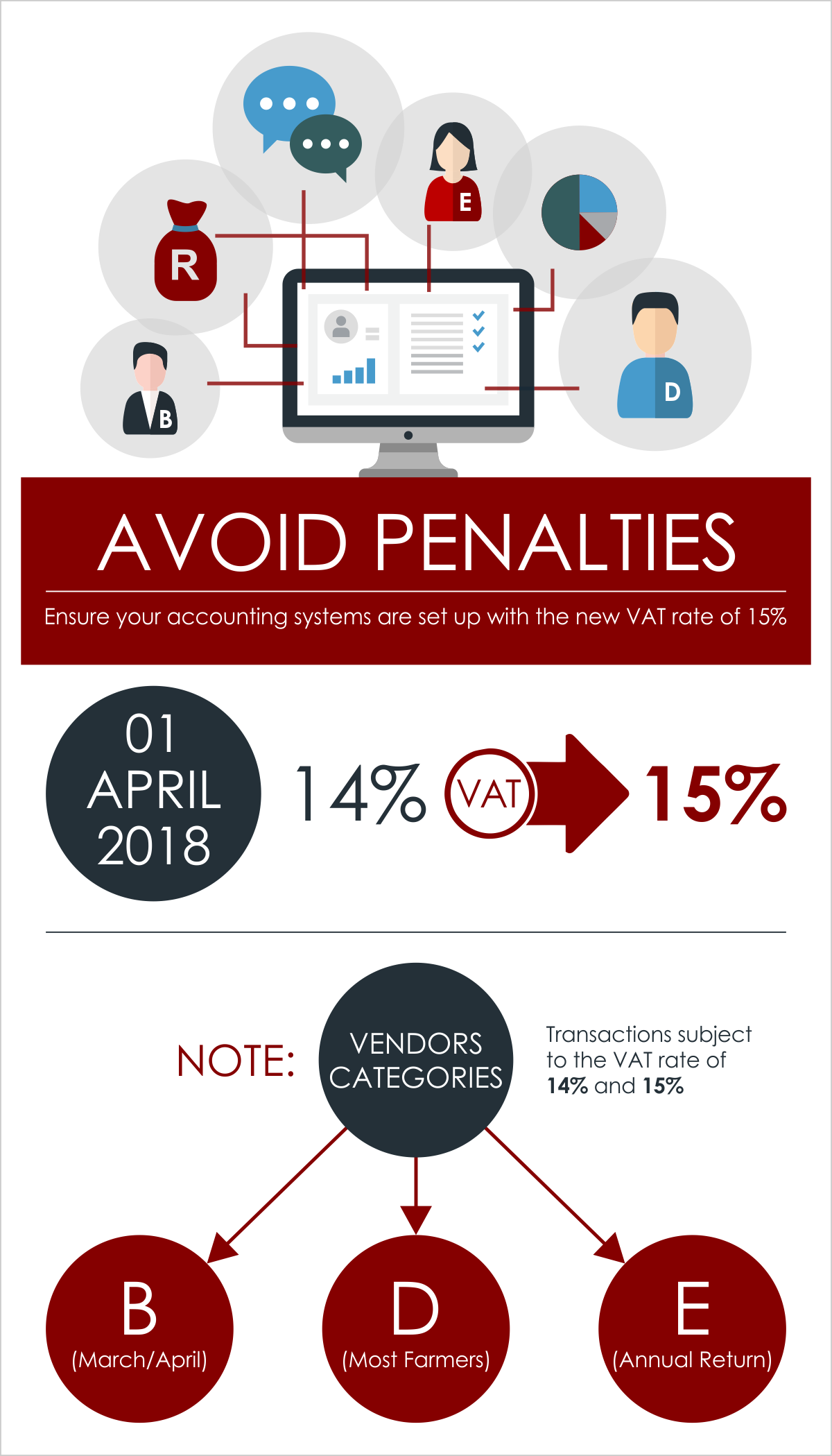

We urge you to ensure that your accounting systems are set up to process transactions at the new VAT rate of 15% from 1 April 2018. This is to avoid any penalties or interest due to an under declaration or an over claim on your VAT201 return.

Also note that vendors under Category B (March/April), Category E (annual return) and most farmers registered under Category D VAT reporting periods, will have transactions subject to the VAT rate of 14% and 15% which must be correctly reflected on the VAT201 return.

Feel free to contact us should you have any questions or require assistance.

This article is a general information sheet and should not be used or relied upon as professional advice. No liability can be accepted for any errors or ommissions nor for any loss or damage arising from reliance upon any information herein. Always contact your financial adviser for specific and detailed advice.